Open High Low Strategy Know the Trading Technique

You should experiment with different time settings to discover what works best for you. Unlike other indicators like the RSI and moving averages, OHLC does not provide pointers as to where the price of an asset will move. Instead, it helps provide an indication as to how the assets are trading and the ranges to watch. Technical analysis is a trading strategy that uses charts and combines them with indicators. For example, if your favorite stock or index has an ATR of $10 and the stock has already done $2 at the open, you have a potential profit margin of $8 for that day.

The first advantage of the OHLC strategy is that it’s easy to use. Both novice traders and experienced day traders can benefit from this trading strategy. Secondly, this trading method doesn’t require prolonged analysis. This means you don’t have to spend countless ohlc intraday strategy hours analyzing the market. OHLC charts show more information than line charts which only show closing prices connected together into a continuous line. OHLC and candlestick charts show the same amount of information, but they show it in a slightly different way.

What is Anchored VWAP? Best Day Trading Indicators Explained

For the intraday open high low strategy to work well, traders must trade in large quantities, for small targets. As a trader, you need to make a quick entry and swift exit to book profits. Note that it is challenging to manage the strategy since it involves a high risk-reward ratio. The aggressive trading strategy is to wait for the first open light to form. There are several day trading strategies when using OHLC bar charts.

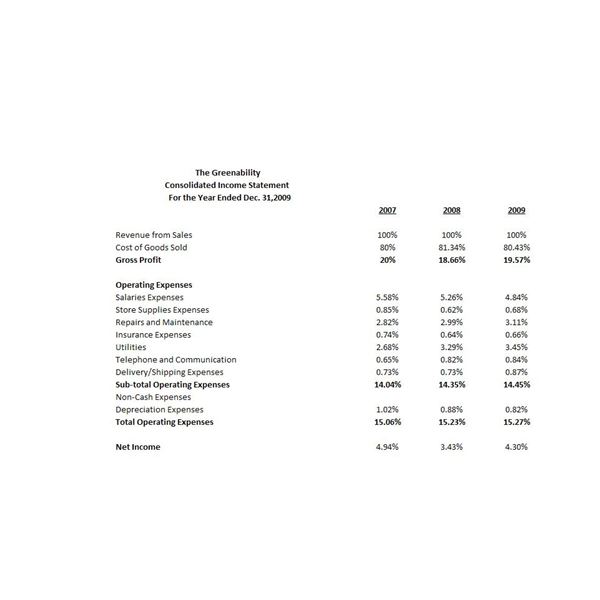

Let’s see how to use the open high low close formula to determine the type of day (bullish or bearish). Make sure to also read our guide on day trading for beginners. Login to your trading account and ensure you have sufficient balances to execute your trade. If the retail price and the high (or low) price are the same, it is most obvious that a conversion trend has begun. Simply put, the rating is the process of adding value to your company.

OHL strategy for day trading

At the start of February, there are large red bars, much larger than any seen during the prior advance. The following is an OHLC chart for the S&P 500 SPDR ETF (SPY). Overall rises are typically marked by a greater number of black bars, like the period at the start of October. Trough mid-November the price moves slightly higher but mostly sideways, marked by more alternating bar colors. Next, let’s see how to set targets with the OHL strategy for day trading. If your preferred stock or index has an ATR of $10 and has since hit $2 outside, the possible profitability for the day is $8.

At the same time, the first-minute candle expanded more than $4 leaving us with a profit potential of $11. However, the stock price only moved an additional $9, which could have been our profit target for the day. As for the stop-loss strategy, you can hide your protective stop-loss order at the previous day’s close. Or, alternatively, you can place it above (below) the current opening price.

Where to win the day deal

Alternatively, it can be placed above (below) the current market price. Then see how you can profit from the fact that today’s high or low is responsible to set at the start of the day. Price action, on the other hand, is the process of analyzing chart patterns with the goal of finding unique arrangements.

Technical Classroom: How to use Heikin-Ashi candlestick for trading – Moneycontrol

Technical Classroom: How to use Heikin-Ashi candlestick for trading.

Posted: Sat, 22 Jun 2019 07:00:00 GMT [source]

There are traders who prefer trading in a period of low volatility and others who prefer trading in a period of high volatility. For example, if you are trading Apple, the open price will be where the price starts the day. This price is determined by the demand and supply of the asset at the start of the day. If the open and close are close together, it shows indecision, since the price couldn’t make much progress in either direction. If the close is well above or below the open, it shows that there was strong selling or buying during the period.